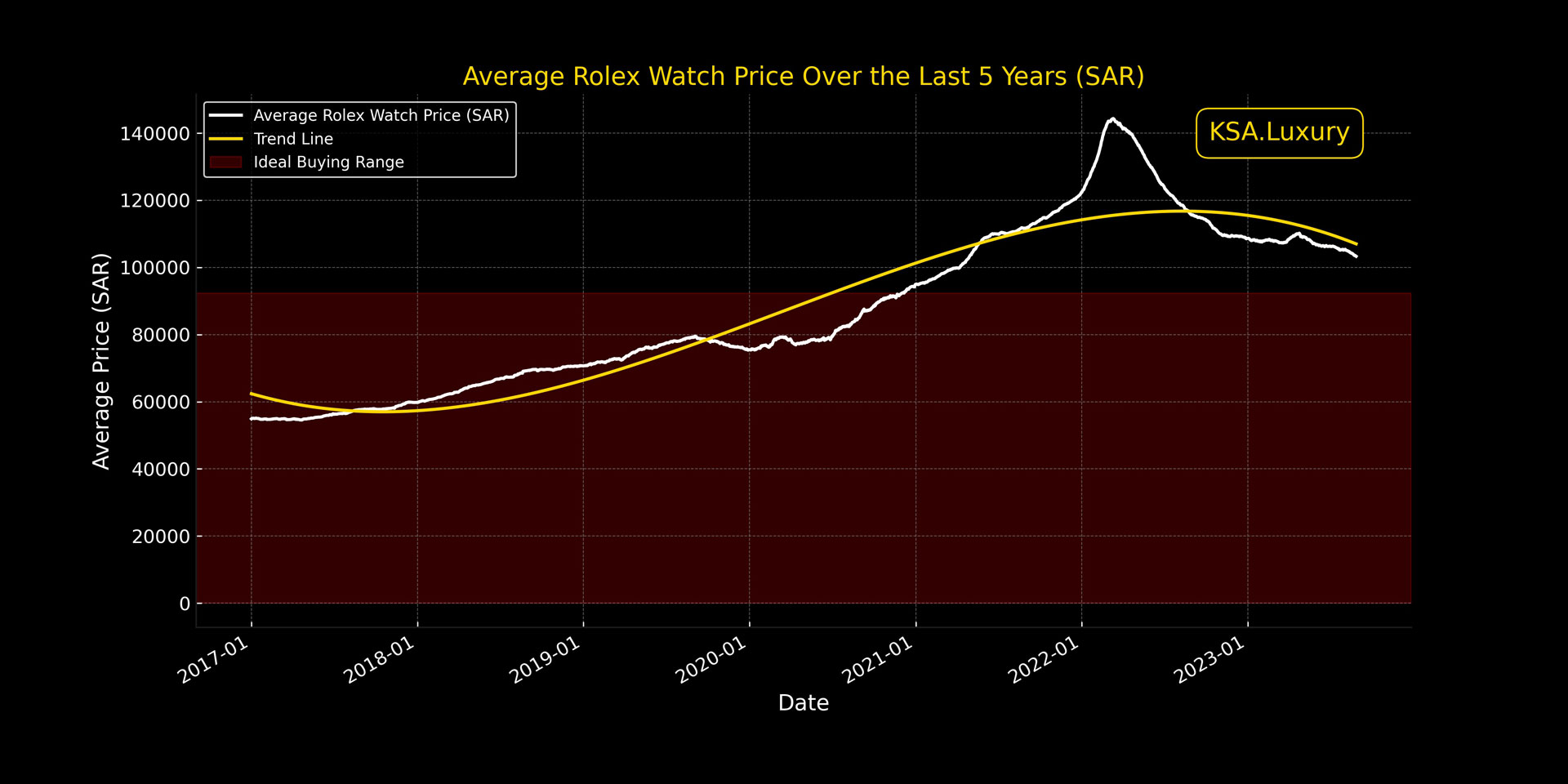

In a world where trends come and go, Rolex watches have consistently defied the odds by maintaining their value and seeing a notable increase. This 5-year chart captures this fascinating journey, revealing fundamental market dynamics and investment opportunities in U.S. Dollars and Saudi Arabian Riyal.

Whether you’re an investor, a collector, or a luxury enthusiast, this data-driven exploration will offer invaluable insights into the Rolex market.

- 3-Month Change: -3.39%

- 6-Month Change: -4.31%

- 1-Year Change: -10.82%

- 3-Year Change: +21.67%

- 5-Year Change: +49.28%

Short-term Fluctuations

In the short term (3 and 6 months), we observed a decline in Rolex watch prices by 3.39% and 4.31%, respectively. This could be attributed to seasonal variations, market corrections, or other transient factors. But it is likely a correction from the heated market 2021 to late 2022, which has slowed compared to the 1-year change.

Mid to Long-term Trends

Interestingly, the 1-year change shows a more significant dip of approximately 10.82%, possibly indicating a broader market trend in reaction to the surge in price previously.

Investment Horizon

For those considering Rolex watches as a longer-term investment, the 3-year and 5-year changes show a promising picture. Prices have increased by 21.67% over 3 years and a substantial 49.28% over the past 5 years, reaffirming the investment potential of Rolex watches.

Understanding the 5-Year Trend

Key Observations

- Overall Increase: The chart illustrates a consistent upward trend in Rolex watch prices, emphasizing the brand’s strong demand and potentially limited supply.

- Yearly Fluctuations: While the general trajectory is upward, the chart reveals periodic fluctuations that could be influenced by various factors such as seasonal demand, new model releases, or broader economic conditions.

- Market Stability: Despite these fluctuations, the Rolex market appears stable, showing no extreme volatility, making it an attractive option for collectors and investors.

Influencing Factors

- Limited Supply: Rolex is known for its meticulous craftsmanship, producing watches in limited numbers, which naturally drives up demand and prices.

- Brand Prestige: The Rolex brand carries a certain allure, built over decades, which continues to attract a high-end clientele.

- Economic Conditions: General economic factors like inflation rates and consumer purchasing power also have a role to play in determining prices.

Market Surges and Corrections

One of the intriguing aspects of the Rolex market is the occurrence of price surges and subsequent corrections. These events can offer market participants valuable timing opportunities for buying and selling.

- What are Surges and Corrections?: A surge refers to a rapid, significant increase in price, while a correction is a subsequent decline to a more ‘sustainable’ value.

- Implications: A surge often signals a good selling opportunity for investors, whereas a correction may be an optimal time to buy. Understanding these patterns can help the average consumer make more informed purchasing decisions.

The Investment Potential of Rolex Watches

Given the stable and increasing prices, a Rolex watch emerges not just as a piece of luxury but also as a potential long-term investment. Historical data shows that owning a Rolex is not merely about flaunting a status symbol; it could also be a financially sound decision.

Ideal Buying Range

The concept of an “Ideal Buying Range” provides a data-driven perspective on favorable price points for prospective buyers. This range is derived from statistical analysis of the trend line and its residuals, offering a risk-mitigated guideline for entry points into the Rolex market. It combines market insights, risk mitigation, and consumer guidance to provide actionable insight for investors and the average consumer.

Tax Implications in Saudi Arabia

If you’re considering a Rolex watch as an investment in Saudi Arabia, be aware of the 15% VAT upon purchase. There is no capital gains tax on selling personal items like watches. Import duties may apply, and no inheritance tax exists, making Rolex an attractive heirloom asset. For current and personalized tax advice, consult a tax advisor.